26+ Calculate Mileage Reimbursement

Understand What Miles Are Reimbursable. Web Using a mileage calculator can help you figure out how much you should be reimbursed for work-related travel.

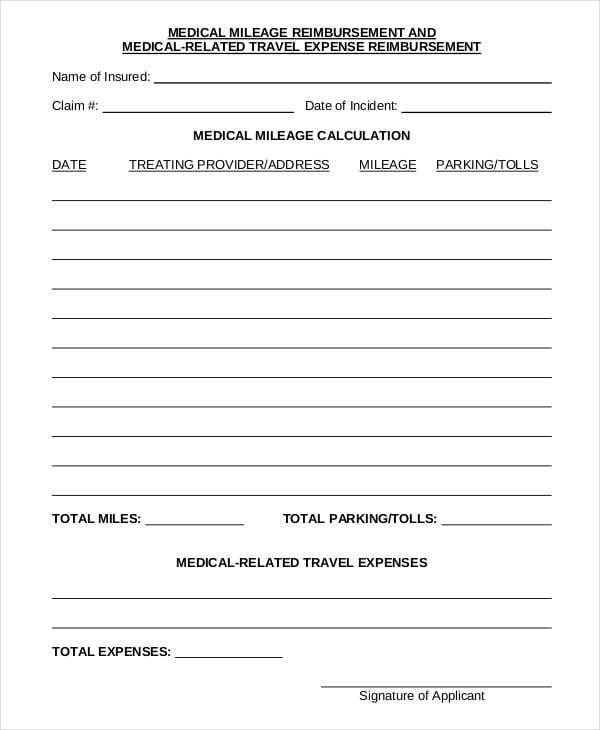

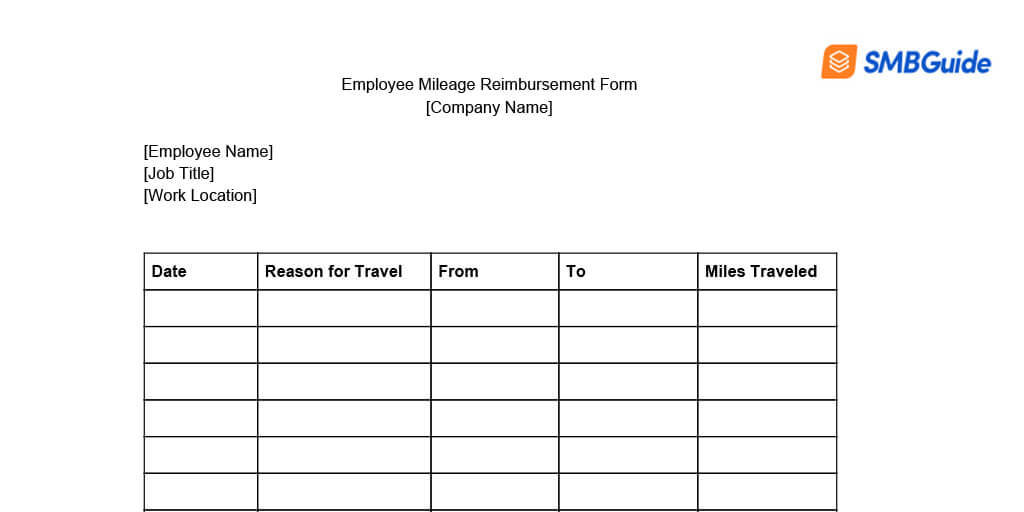

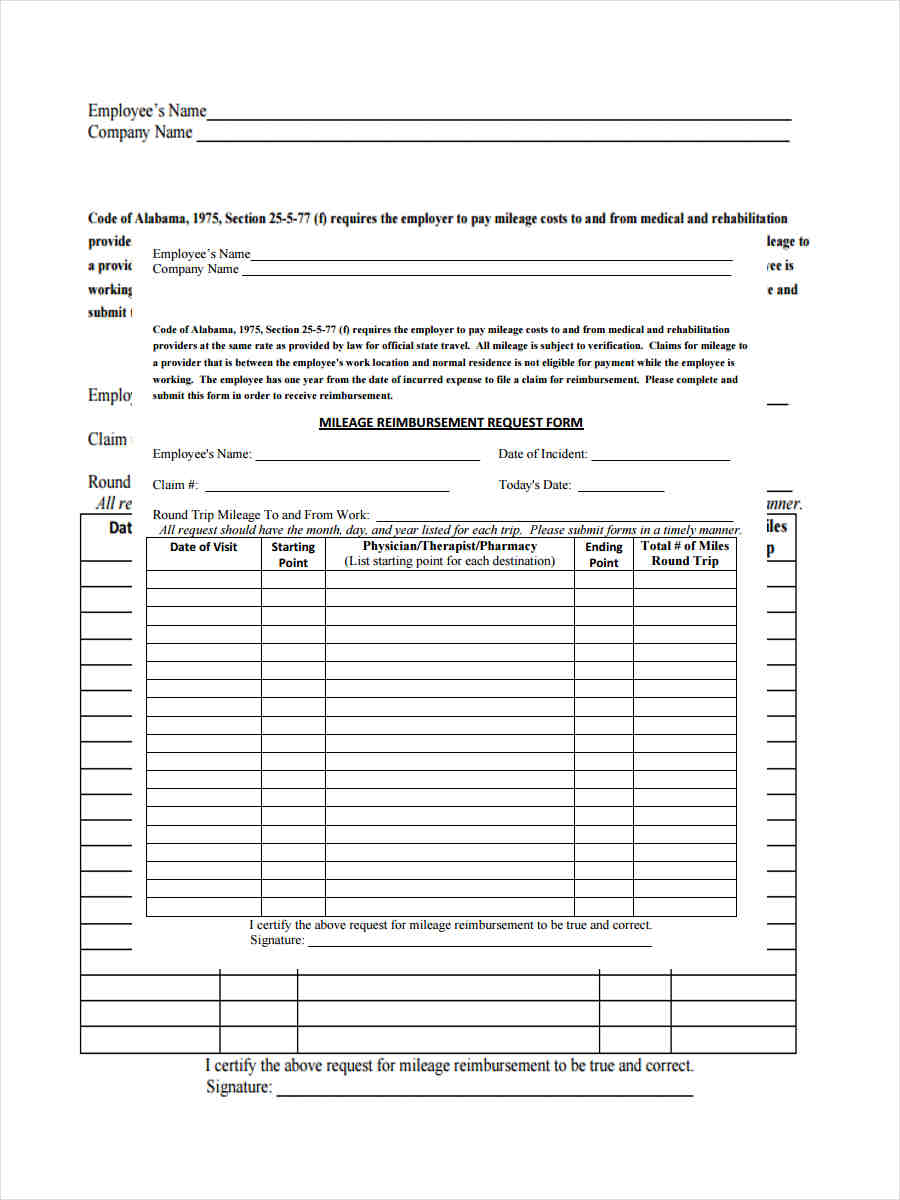

Mileage Reimbursement Form 10 Free Sample Example Format

Web To calculate your mileage reimbursement you can take your total business miles and multiply them by the standard IRS mileage rate.

. Web There are two methods of calculation you can choose to use. Being Reimbursed for Miles or. Reimbursements based on the federal mileage rate arent considered income making.

Try out this calculator to automatically. Web The IRS has a standard mileage rate SMR for the business use of your personal vehicle. Web In those 500 miles you did 5 business trips that totaled 100 miles.

It can also help you find out the cost of an upcoming road trip and. For medical expenses you can claim. Privately Owned Vehicle POV Mileage.

Web Updated June 2020. The rate for tax year 2023 is 655 cents per mile. Web For 2020 the federal mileage rate is 0575 cents per mile.

Web 17 rows Find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business charitable medical or moving expense purposes. Web For cars employees use for business the portion of the standard mileage rate treated as depreciation will be 26 cents per mile for 2022 unchanged from 2021. Make sure you know the rules and best practices.

Web To find your reimbursement you multiply the number of miles by the rate. Miles rate or 175 miles 0655 11463. Transportation Airfare POV etc Privately Owned Vehicle Mileage Rates.

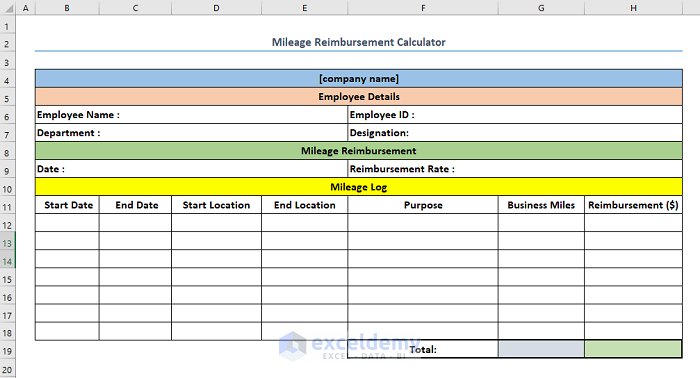

0655 100 miles 6550. Web For 2021 the IRS mileage reimbursement rate is 56 cents per mile driven for business use. Enter your data and then look for the Total Reimbursement amount at the bottom.

Then you need to be. Ad A G2 Leader in mileage tracking based on real customer reviews. Mileage reimbursement is what an employer pays an employee for business-related use of their personal vehicle.

With this in mind well. Web IR-2022-234 December 29 2022 The Internal Revenue Service today issued the 2023 optional standard mileage rates used to calculate the deductible costs of. To calculate your business share you would divide 100 by 500.

1-rated mileage tracking app takes the tedious work out of reporting reimbursement. Web This calculator can help you track you mileage and can accommodate 2 different rates. Web WASHINGTON The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an.

Web What is mileage reimbursement. A mileage reimbursement program can be critical to your business success. Use a Mileage Rate Calculator.

The standard mileage deduction is the simplest and most common method employed to calculate mileage. Does your organization provide vehicles to its employees. Web Step 1.

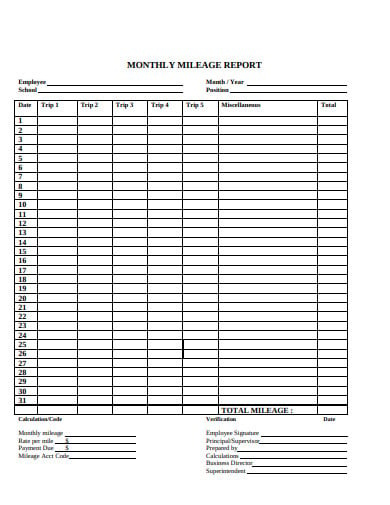

How To Calculate Mileage Reimbursement In Excel Step By Step Guide

Workers Comp Mileage Reimbursement Form Fill Online Printable Fillable Blank Pdffiller

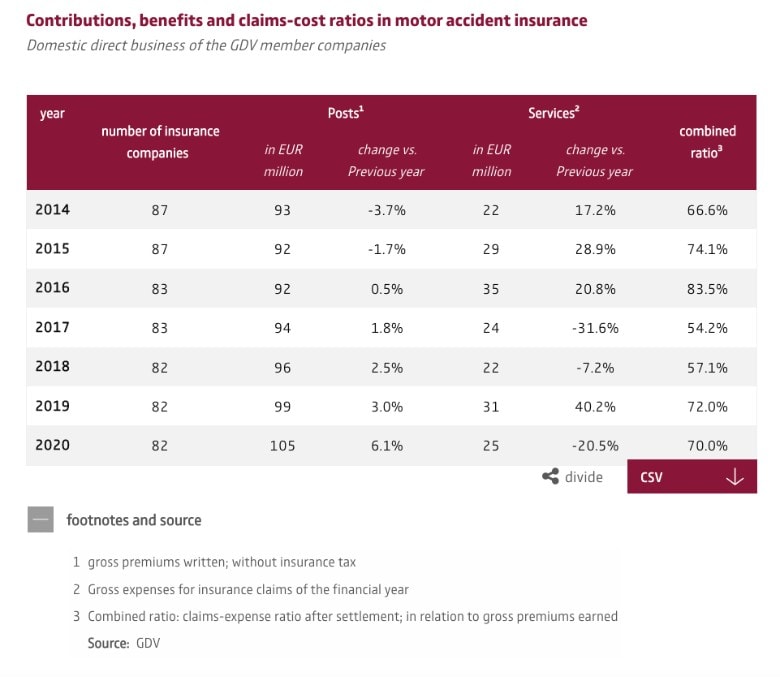

Car Insurance In Germany In Depth 2023 English Guide

How To Calculate Your Mileage For Reimbursement Triplog

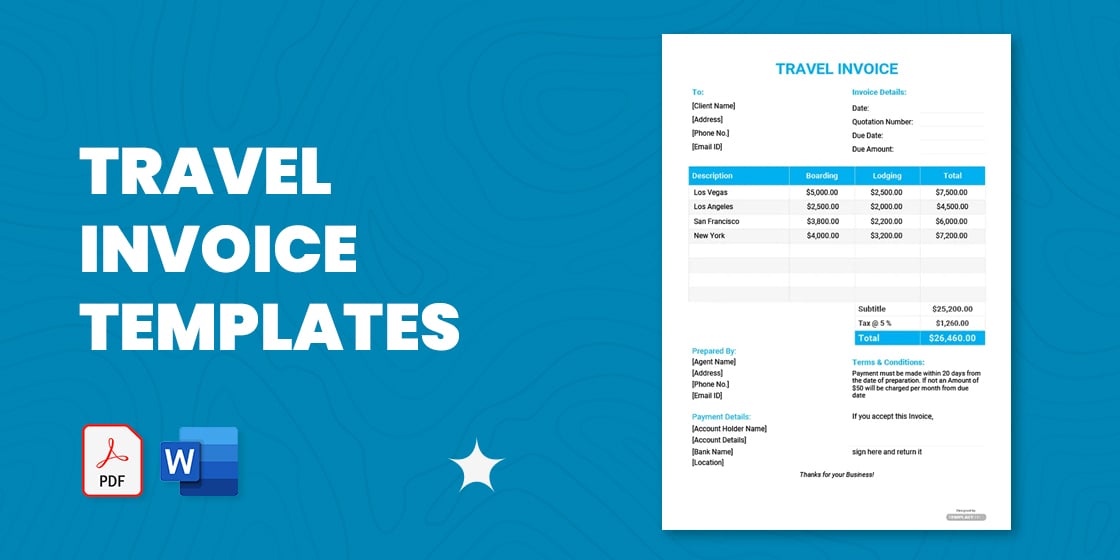

26 Travel Invoice Templates Pdf Docs Excel

Business Mileage Deduction 101 How To Calculate For Taxes

Mileage Reimbursement For Employees Info Free Download

19 Mileage Report Templates In Google Docs Pages Numbers Word Pdf

Mileage Reimbursement Calculator Mileage Calculator From Taxact

Mileage Reimbursement Calculator

2023 Mileage Reimbursement Calculator Travelperk

How To Calculate Mileage For Irs Taxes Or Reimbursement 2023 Updated

Mileage Reimbursement Fill Online Printable Fillable Blank Pdffiller

Free 12 Mileage Reimbursement Forms In Pdf Ms Word Excel

Gas Mileage Log And Calculator Gas Mileage Mileage Chart Mileage Log Printable

2023 Mileage Reimbursement Calculator Travelperk

2023 Mileage Reimbursement Calculator Travelperk